Property Tax Changes Summary

Author: Broadwater County Commissioners

HB 231 & SB 542: Property Tax Changes Summary

Megan Moore

MT Legislative Office of Research & Policy Analysis

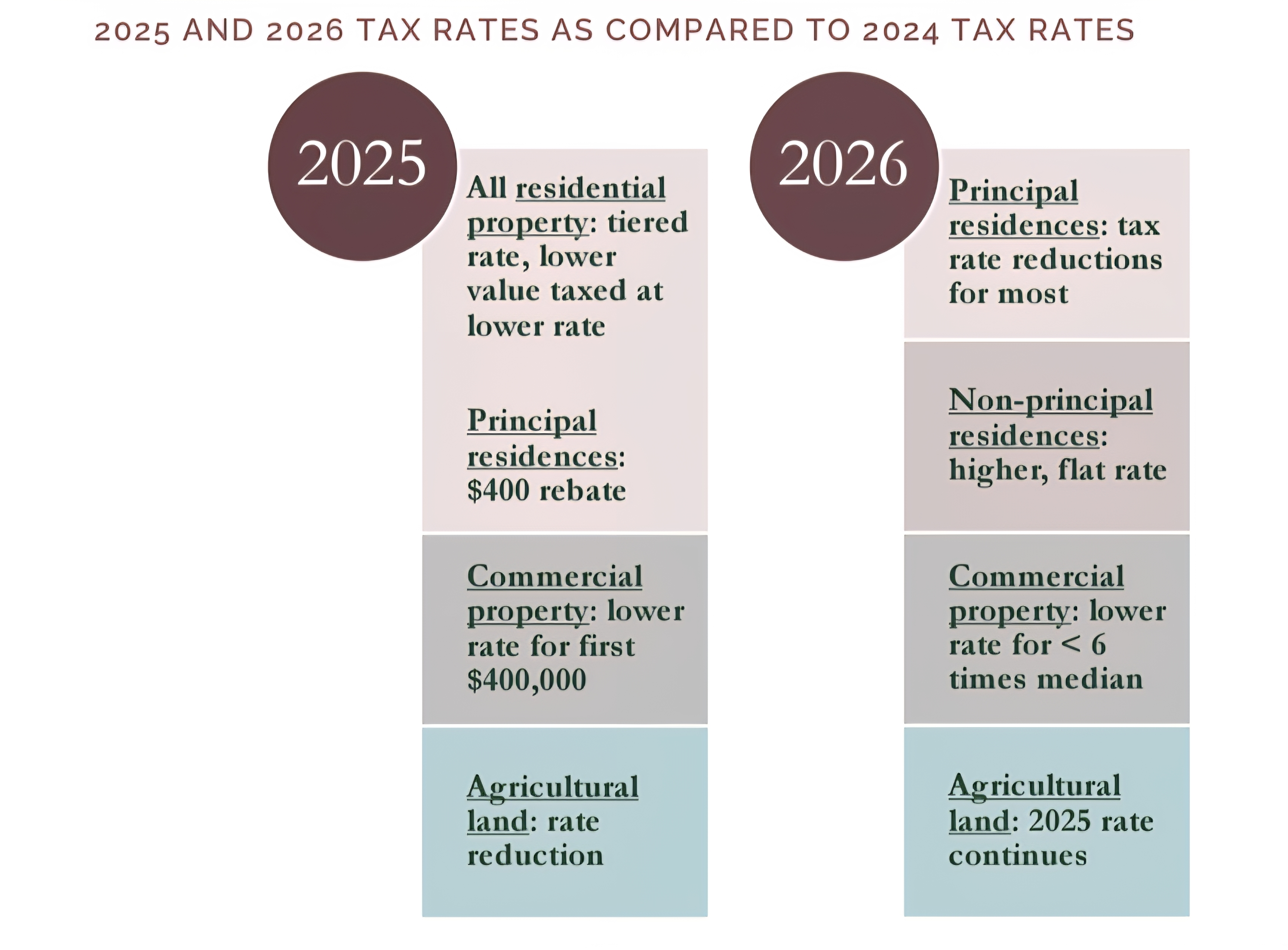

After years of large increases in residential property values, the 2025 Legislature revised tax rates for residential, commercial, and agricultural property. Changing the tax rate that applies to a property’s market value revises the taxable portion of a property’s value and the amount of property taxes paid. These tax rate revisions are a balancing act, however, as lowering the tax rate for some properties shifts property taxes to properties that do not receive rate reductions.

LOWER RATES FOR RESIDENTIAL, COMMERCIAL, AG PROPERTY

TIERED RATES FOR RESIDENTIAL PROPERTY, BENEFITS FOR PRINCIPAL RESIDENCES

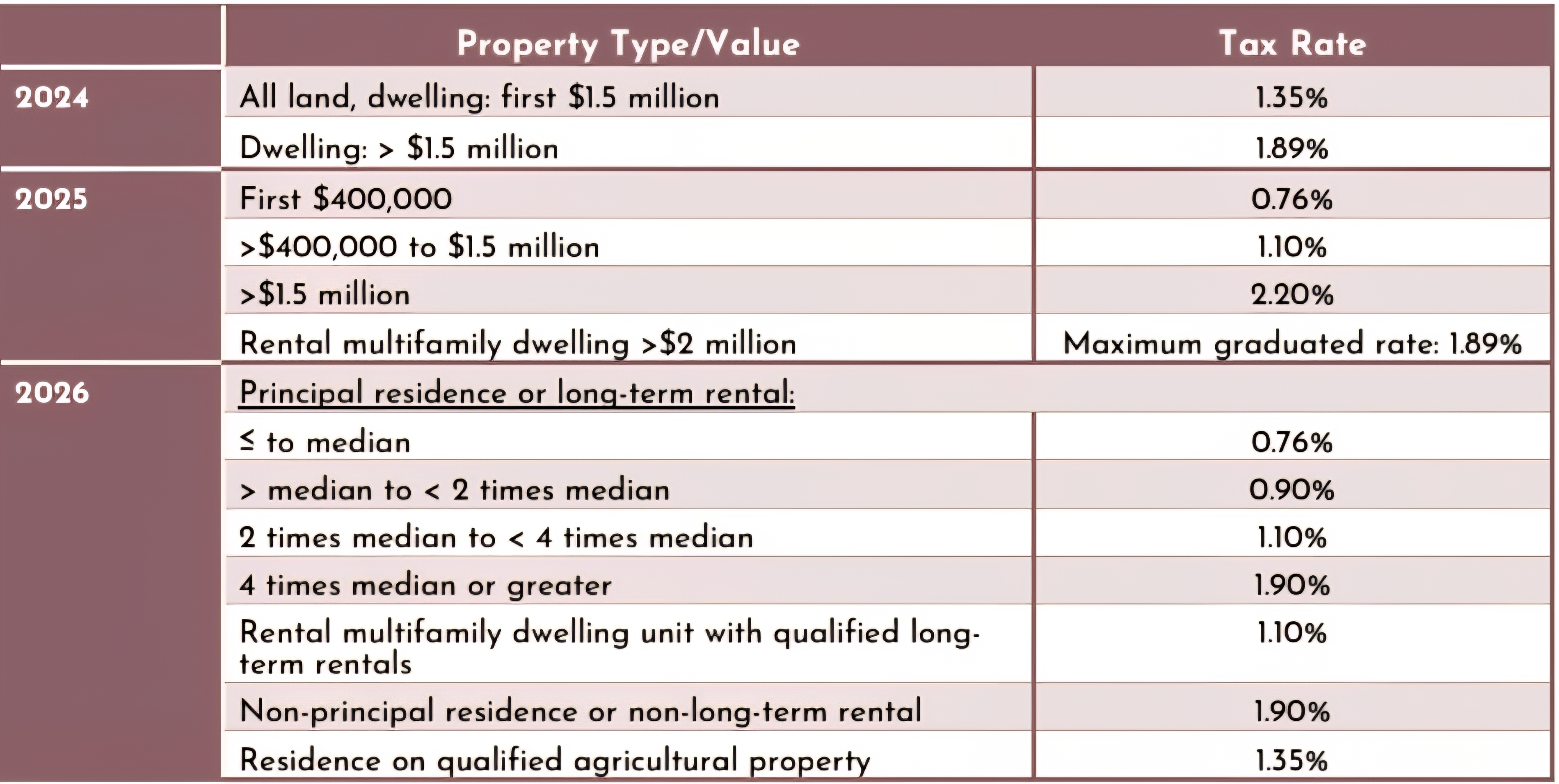

Graduated tax rates go into effect beginning ino 2025 for residential and commercial properties with a lower tax rate applying to a portion of all properties and the rates increasing as property value increases.

The legislation also provides a one-time rebate for principal residences. The rebate is available to homeowners who owned and resided in their residence for at least 7 months in 2024 and is equal to property taxes paid up to a maximum of $400.

The Department of Revenue (DOR) will mail information about the rebates by June 30, 2025.

Homeowners must apply online or return a paper application between Aug. 15, 2025, and Oct. 1, 2025, to receive the rebate.

COMMERCIAL AND INDUSTRIAL PROPERTIES SWITCH TO GRADUATED TAX RATES

For tax year 2025, the tax rate for the first $400,000 of class four commercial and industrial property is 1.40% and the tax rate for additional value is 1.89%. In 2026, the rates change to 1.50% for the value that is less than six times the statewide median commercial and industrial value and 1.90% for the value above six times the median.

AGRICULTURAL LAND TAX RATES DECREASE BEGINNING IN 2025

The tax rate for qualified agricultural property will decrease from 2.16% in 2024 to 2.05% in 2025 and

2026, while the tax rate for nonqualified agricultural property will be reduced from 15.12% to 14.35%.

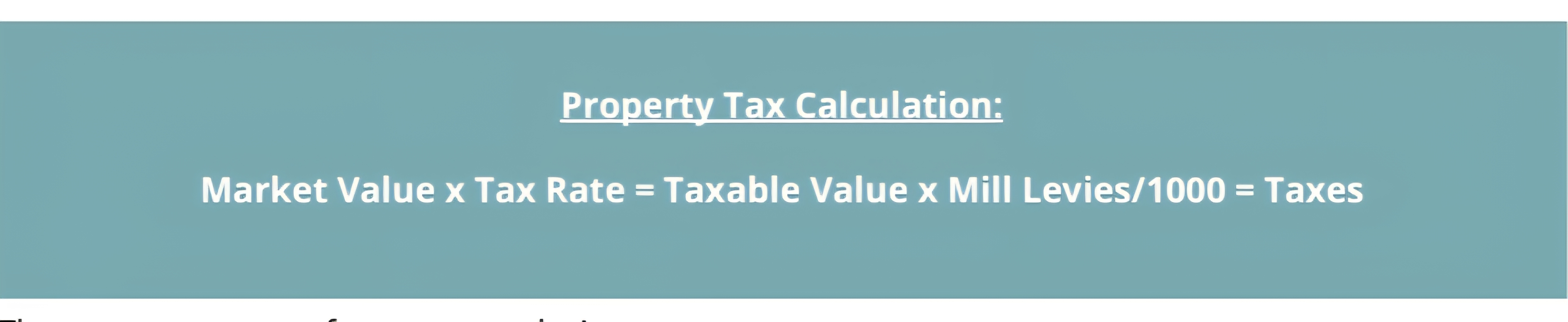

IMPACT ON TAX BILLS WILL VARY BY JURISDICTION, PROPERTY

Lower tax rates for many residential, commercial, and agricultural properties will reduce taxable values but that impact may be tempered by mill levy increases.

There are two types of property tax levies:

• Dollar-based levies adjust the number of mills to raise a specified dollar amount.

• Fixed mill levies allow a taxing jurisdiction to levy a maximum number of mills.

MILL INCREASES FOR DOLLAR-BASED LEVIES MAY SHIFT TAXES, TEMPER BENEFITS

Lowering tax rates for certain classes of property reduces taxable value. Jurisdictions may increase mill levies to raise the same amount of revenue from the reduced taxable value.

The impact on properties with reduced taxable values and increased mill levies depends on the relative size of the value reductions and mill increases. Mill increases shift taxes to properties with 2025 or 2026 values that are the same or higher than 2024 values.

Article Images

Click on Image Thumbnail(s) to view fullsize image

Image 1 Caption: County Logo

Image 2 Caption: Legislative Services Logo

Image 3 Caption: Graphic 1

Image 4 Caption: Graphic 2

Image 5 Caption: Graphic 3